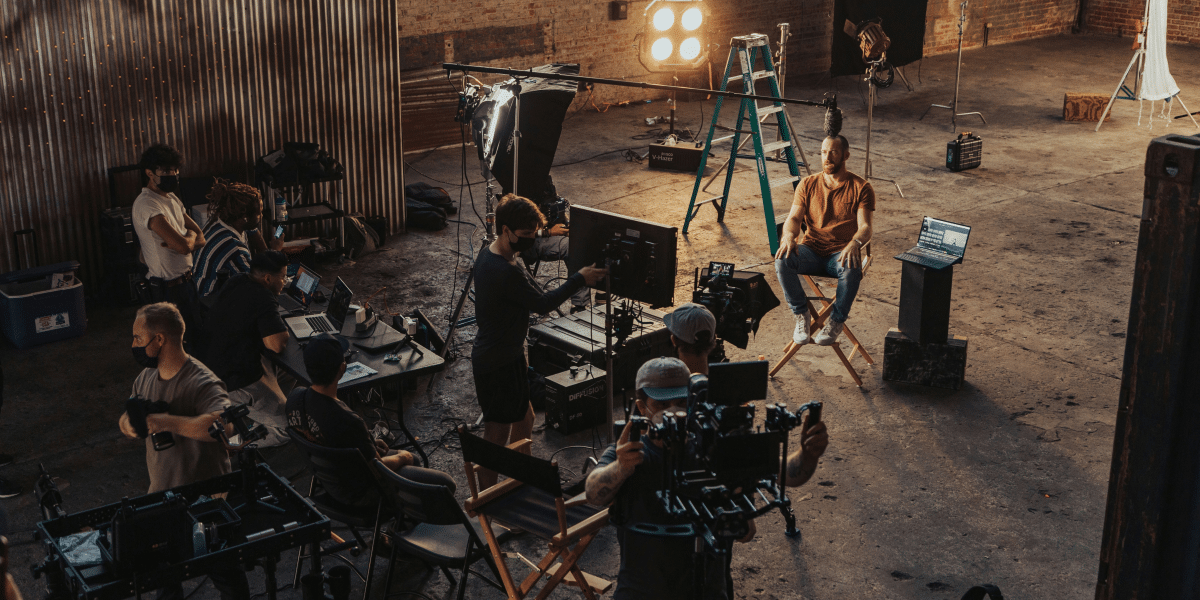

Image Commercially Licensed from Unsplash

In the ever-evolving landscape of global finance, adaptability and innovation are essential for success. Astor Wealth Group, under the visionary leadership of CEO Thomas Mellon, embodies these principles as it takes a bold step forward in its expansion into the thriving city of Shenzhen, China. This strategic move not only bolsters Astor’s global presence but also underscores its unwavering commitment to delivering diverse and innovative financial services to its Asian clientele.

In a significant move, Astor Wealth Group, under the dynamic leadership of CEO Thomas Mellon, has expanded its financial presence in the vibrant city of Shenzhen, China.

Astor Wealth Group aims to cater to the growing market demand by offering innovative financial solutions in the form of China A and B securities lending. This move not only strengthens Astor’s global footprint but also showcases its commitment to providing diverse financial services to their Asian clients.

One of the key facets of Astor Wealth Group’s expansion in Shenzhen is its foray into China A and B securities lending. Securities lending often involves lending borrowed securities to facilitate short selling or serve as collateral for various financial transactions. However, lending China’s A-Share securities introduces unique complexities for foreign firms, primarily due to stringent regulatory constraints and distinct market dynamics. Astor Wealth Group, with its expertise and unwavering determination, is adeptly navigating these intricate challenges to offer its clients access to previously untapped opportunities.

Embracing Emerging Market Trends

Shenzhen, often referred to as the Silicon Valley of China, stands at the forefront of the country’s financial technology revolution. Its strategic location and progressive business environment make it an ideal hub for Astor’s expansion into China A and B securities lending. By establishing a significant presence in this dynamic city, Astor Wealth Group underscores its commitment to staying ahead of emerging market trends and capitalizing on transformative opportunities.

The decision to expand in Shenzhen, the forefront of China’s financial technology revolution, demonstrates Astor Wealth Group’s dedication to capitalizing on emerging market trends. Shenzhen’s strategic location and progressive business environment make it an ideal base for Astor’s pursuit of China A and B securities lending.

To successfully enter the market and provide top-notch lending services, Astor Wealth Group has been diligently establishing strategic partnerships with several reputable tier-1 custodians in Shenzhen and Beijing including China Everbright Bank and Huatai Securities.

Navigating Regulatory Challenges with Expertise

Navigating the regulatory intricacies of China’s financial market requires a deep understanding of local laws and regulations, as well as the ability to adapt swiftly to changes in the regulatory environment. Astor Wealth Group’s commitment to providing comprehensive financial solutions is evident in its proactive approach to meeting regulatory requirements, ensuring compliance, and safeguarding its clients’ interests. This dedication sets a new precedent for foreign financial firms seeking to operate in China.

Astor’s concerted efforts in overcoming the difficulties of catering to the Chinese market demonstrate the company’s commitment to providing comprehensive financial solutions in increasingly challenging markets. As Astor Wealth Group blazes a trail in China’s securities lending arena, investors can confidently anticipate more accessible and efficient liquidity solutions.