By: Jacob Maslow

Foreclosure is a complex legal process where a lender attempts to recover the balance of a loan from a borrower who has stopped making payments. Understanding the foreclosure process in California is crucial for homeowners and investors alike, as it helps in navigating the legal landscape and making informed decisions. This article provides a comprehensive overview of the foreclosure processes and timelines in California, focusing on both non-judicial and judicial foreclosures.

Overview of Foreclosure in California

California primarily uses two types of foreclosure processes: non-judicial and judicial. Non-judicial foreclosures are more common due to their efficiency and lower cost. Judicial foreclosures, while less common, are also used and involve a court process.

Pre-Foreclosure Period

Before a foreclosure can begin, a borrower must be at least 120 days past due on their mortgage payments. During this pre-foreclosure period, borrowers have the opportunity to explore loss mitigation options such as loan modifications, repayment plans, or forbearance agreements. It is crucial for borrowers to communicate with their lenders to understand all available options and potentially avoid foreclosure.

Non-Judicial Foreclosure Process

Notice of Default (NOD)

The foreclosure process officially starts with the Notice of Default (NOD). This document is recorded after the borrower is at least 120 days delinquent. The borrower then has 90 days to cure the default by paying the overdue amount. During this period, the borrower can also seek to negotiate with the lender for possible alternatives to foreclosure.

Notice of Trustee’s Sale

If the borrower fails to remedy the default within 90 days, a Notice of Trustee’s Sale is issued. This notice must be posted on the property and published in a local newspaper. The sale date must be at least 20 days from the issuance of the notice. The notice includes important details such as the date, time, and location of the auction.

Foreclosure Auction

The property is then sold at a public auction to the highest bidder. The winning bidder must pay in cash or certified funds, and the ownership is transferred immediately upon payment. The auction process is straightforward but can be competitive, with multiple bidders vying for the property.

Judicial Foreclosure Process

In a judicial foreclosure, the lender files a lawsuit against the borrower. This process is less common due to its length and cost. The judicial process begins with the filing of a complaint and the service of summons on the borrower. The borrower has the opportunity to respond and contest the foreclosure in court.

After a court judgment, a Notice of Sale is issued, and the property is sold at a public auction similar to the non-judicial process. Judicial foreclosures typically allow for a longer redemption period, giving borrowers more time to reclaim their property.

Borrower Rights and Protections

California’s Homeowner Bill of Rights provides significant protections for borrowers, including:

- Prohibitions on dual-tracking (processing a loan modification and foreclosure simultaneously)

- Requirement for a single point of contact for borrowers

- Enhanced notice requirements and timelines to ensure borrowers are well-informed

These protections are designed to ensure fair treatment and provide borrowers with opportunities to avoid foreclosure whenever possible.

Redemption and Deficiency Judgments

In judicial foreclosures, borrowers have a redemption period, typically up to one year, to reclaim their property by paying the foreclosure sale price plus interest. Deficiency judgments, where lenders seek the remaining balance after a foreclosure sale, are limited under California law. This means that borrowers are not always responsible for the entire loan balance if the sale price does not cover the debt.

Alternatives to Foreclosure

Borrowers facing foreclosure can consider several alternatives:

- Loan Modification: Adjusting the terms of the loan to make payments more manageable.

- Short Sale: Selling the property for less than the loan balance with the lender’s approval.

- Deed in Lieu of Foreclosure: Voluntarily transferring the property to the lender to avoid foreclosure.

- Selling Mortgage Notes: Provides a lump sum of cash and helps avoid the negative impact of foreclosure. Understanding the process and benefits of selling mortgage notes is crucial for making an informed decision.

Comparative Insights

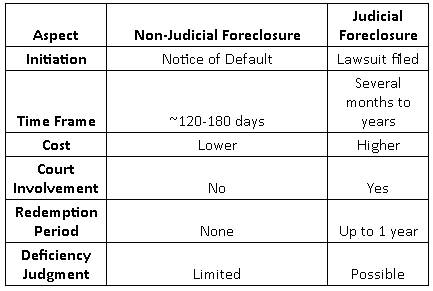

California’s non-judicial foreclosure process is generally faster and less expensive compared to other states that rely more heavily on judicial foreclosures. This efficiency benefits both lenders and borrowers by reducing the time and cost involved. The table below provides a comparative overview of non-judicial and judicial foreclosure processes:

Conclusion

Understanding the foreclosure process in California, including the timelines and legal requirements, is essential for navigating this challenging situation. Homeowners should be aware of their rights and explore all available options to avoid foreclosure when possible. Staying informed and proactive can help mitigate the impact of foreclosure and lead to better financial outcomes.

Disclaimer: This article is intended for informational purposes only and does not constitute legal advice. Readers should consult with a qualified attorney or financial advisor to discuss their specific circumstances and receive personalized advice. The information provided is based on current laws and regulations, which are subject to change. The author and publisher are not responsible for any actions taken based on the content of this article.

Published by: Khy Talara